Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Appropriate roles: Owner and Financial Contributor

This article describes the various aspects of taxation in the Microsoft global operations of Microsoft Commercial Marketplace. Any terms not expressly defined on this page are defined in the Marketplace Publisher Agreement. If it's a Multiparty Private Offer, the information here applies to Authorized Partners unless stated otherwise. For purposes of this content, "Microsoft" refers to Microsoft Corporation and/or any of its affiliated legal entities.

The information in this article is subject to change. Publishers and authorized Partners are responsible for reviewing this page for the most current and accurate information.

Microsoft legal entity with which a publisher contracts

Microsoft Corporation, an entity incorporated under the laws of the United States of America, operates Commercial Marketplace globally. All Publishers and authorized Partners who transact through Commercial Marketplace enter into the Microsoft Publisher Agreement with Microsoft Corporation. Microsoft Corporation makes all payouts to Publishers and authorized Partners.

Microsoft Corporation Taxpayer Information:

- Region/Country: United States

- Legal Entity Name: Microsoft Corp

- Entity Legal Address: One Microsoft Way, Redmond, WA 98052

- US EIN (Taxpayer ID): 91-1144442

Microsoft and Publishers' roles and responsibilities related to tax

Publishers can set up various Partner Center accounts in different jurisdictions and choose which countries/regions those accounts sell into. The country/region where you choose to sell determines each party's obligations for Transaction Taxes. For more information, see the following Responsibility for offer taxation chart and the Tax responsibilities for Microsoft Commercial Marketplace article.

As the Marketplace Publisher Agreement describes, in all jurisdictions except reseller countries, Microsoft is your agent or commissionaire, as applicable, to facilitate customer purchases through the Commercial Marketplace. In this role, it's important to understand:

- (A) Microsoft receives on your behalf, amounts that a customer pays when the customer acquires any of your offers through the Commercial Marketplace;

- (B) Microsoft's services include the processing of purchases, returns, and chargebacks arising out of the purchase by customers of your offers;

- (C) Microsoft has the right to appoint any Covered Parties (solely as required to administer Transaction Tax obligations and for collection and payout of applicable fees made under the Agreements) as subagents and grant any Covered Party appointed by Microsoft the right to appoint other Covered Parties as subagents;

- (D) Microsoft Corporation makes payments to you; and

- (E) Depending on the country/region where the customer is located, Microsoft might be responsible for collecting and remitting Transaction Taxes to the taxing authority. For more information, see Microsoft legal entity managing offer taxation.

Review the Agreements clauses that relate to the information in this section.

Microsoft legal entity managing offer taxation

For more information and a list of jurisdictions where Microsoft manages offer taxation, see Marketplace tax details.

In Microsoft-managed jurisdictions where you sell, Microsoft manages offer taxation through either local affiliates or locally registered remote affiliates.

For sales to customers in the United States, Microsoft Corporation, as a marketplace facilitator, is responsible for calculating, collecting, and remitting sales tax and the sellers' use tax to the applicable tax authority. It includes all jurisdictions that impose sales tax except U.S. territories.

For customers in Latin America (LATAM) in Microsoft-managed countries/regions, Microsoft Corporation manages offer taxation unless there's a local entity that remits tax locally.

For customers in Europe, the Middle East, and Africa (EMEA) in Microsoft-managed countries/regions, Microsoft Ireland Operations Limited manages offer taxation unless there's a local entity that remits tax locally.

For customers in Asia Pacific (APAC) in Microsoft-managed countries/regions, Microsoft Regional Sales Pte Limited (a Singapore-based entity) manages offer taxation unless there's a local entity that remits tax locally.

Offer taxation for customers purchasing under their MCA or EA

In Microsoft-managed countries/regions, Microsoft acts as your agent. Microsoft assumes responsibility to manage offer taxation, including calculating, collecting from customers, and remitting to the tax authority applicable sales, goods, and services, value added or similar taxes. Microsoft invoices customers for these taxes in Microsoft's name and under Microsoft's registration number. Microsoft reports any taxes collected from customers on Microsoft's tax return.

In Reseller countries/regions, Microsoft acts as a reseller in making your Offers available through Commercial Marketplace. You're responsible for Transaction Taxes, if any, on the sale of Offers to Microsoft, and Microsoft is responsible for all offer taxation on the resale to customers.

In Publisher-managed countries/regions, you're solely responsible to determine all compliance required for, and to manage, offer taxation, including but not limited to registration, tax calculation, tax collection, tax remittance, validation of customer business status, and providing tax invoices to customers.

Tax considerations on indirect models

Microsoft Licensing Solution Partner (LSP) and Microsoft Cloud Solution Provider (CSP) are partners that help businesses manage Microsoft licensing. LSPs manage volume licensing contracts for large enterprises, while CSPs manage cloud-based licensing for businesses.

Offer taxation for customers with indirect enterprise agreements

For transactions involving customers with indirect enterprise agreements, the Licensing Solution Partner (LSP) acts as a reseller of the products/offers available for sale through Commercial Marketplace. The LSP is considered the customer for the Commercial Marketplace purchase.

For Microsoft-managed and reseller countries/regions, Microsoft assumes responsibility for managing offer taxation. Offer taxation is based on the sale to the LSP. The LSP is responsible for managing taxation on the resale to their onward customer.

For Publisher-managed countries/regions, Publishers have sole responsibility to determine all compliance required for, and to manage, offer taxation, including but not limited to registration, tax calculation, tax collection, tax remittance, validation of business status of the LSP and providing tax invoices to the LSP. Offer taxation is based on the sale to the LSP. Microsoft manages the LSP is responsible for managing taxation on the resale to their onward customer.

Offer taxation for Cloud Solution Provider (CSP) participants

For transactions with CSP partners, the CSP acts as a reseller and is considered the customer for the Commercial Marketplace purchase.

For Microsoft-managed and reseller countries/regions, Microsoft assumes responsibility for managing offer taxation, including calculating, collecting and/or remitting certain taxes. Offer taxation is based on the sale to the CSP. The CSP is responsible for managing taxation on resale to their onward customer.

For Publisher-managed countries/regions, Publishers have the sole responsibility to determine all compliance required for, and to manage, offer taxation, including but not limited to registration, tax calculation, tax collection, tax remittance, validation of business status of the CSP and providing tax invoices to the CSP. Offer taxation is based on the sale to the CSP. The CSP is responsible for managing taxation on resale to their onward customer.

Responsibility for offer taxation

This chart shows the responsibilities for offer taxation.*

| Responsibility for offer taxation | Direct Model | Indirect Model |

|---|---|---|

| Microsoft-managed | Microsoft assumes responsibility for managing customer taxation, including calculating, collecting, and remitting taxes. | Microsoft assumes responsibility for managing Taxation, including calculating, collecting, and remitting taxes. |

| The LSP and/or CSP is the customer and the recipient of Microsoft’s invoice. | The LSP and/or CSP is responsible for managing taxation related to the resale to their onward customer. | |

| Publisher-managed | Publisher remains responsible for managing customer taxation, including calculating, collecting, and remitting taxes. | Publisher remains responsible for managing Taxation, including calculating, collecting, and remitting taxes. |

| The LSP and/or CSP is the customer and the recipient of Microsoft’s invoice. | The LSP and/or CSP is responsible for managing taxation related to the resale to their onward customer. | |

| Reseller | Microsoft is responsible for all customer taxation on the resale to customers. | Microsoft is responsible for all customer taxation. |

| The LSP and/or CSP is the customer and the recipient of Microsoft’s invoice. | The LSP and/or CSP is responsible for invoicing and taxing their onward customer. |

*The previous chart doesn't apply to Multiparty private offers ("MPO"). If it's an MPO, Microsoft invoices the customer according to their billing terms with Microsoft and Microsoft pays the ISV and the channel partner. For more information, see Marketplace multi-party private-offers.

Withholding tax

Payments from Microsoft to you might be subject to withholding tax, depending on the jurisdiction in your tax profile and where your customers are located.

To have a transactable offer in Commercial Marketplace, you must create a tax profile which contains the information required by Microsoft to comply with tax withholding and reporting requirements. For more information, see Set up commercial marketplace payout and tax profiles.

For Publishers registered outside of the United States that make sales to customers in the United States, Microsoft Corporation withholds applicable tax from your payout at a 30% tax rate unless you have a valid tax certificate electing treaty benefits. In the case of a valid tax certificate, the tax rate is the reduced tax rate under the applicable income tax treaty.

It's important that you provide the appropriate, required tax forms to determine if withholding tax is applicable on the payments issued by Microsoft Corporation. The documentation you submit as part of your tax profile determines the tax withholding rate to be applied on your payout.

You might receive one or more tax forms from Microsoft Corporation each year, depending on your sales, your location, and the number of payments you receive. Microsoft Corporation is required to issue these forms and file them with the Internal Revenue Service (IRS). For more information, see Understand IRS tax forms.

Tax consideration on Store Service Fee

Microsoft might charge applicable Transaction Taxes on the Store Service Fee ("Store Service Fee Taxes"). The Microsoft legal entity that's charging the tax, reports and remits any taxes charged. Store Service Fee Taxes are deducted from Payout. See the reports that Microsoft makes available to you to identify the amount of these taxes.

Currently, the Transaction Tax on the Store Service Fee is collected and deducted from the Payout if the customer is in Australia, Canada, Mexico, New Zealand, or Singapore.

Payout Considerations

In Microsoft-managed countries/regions and reseller countries/regions, Microsoft deducts the Store Service Fee, any Store Service Fee Taxes, Transaction Taxes collected as part of offer taxation, and any applicable withholding tax from the amount you're paid. Microsoft provides reports that identify the amount of these taxes in case any of these deductions apply.

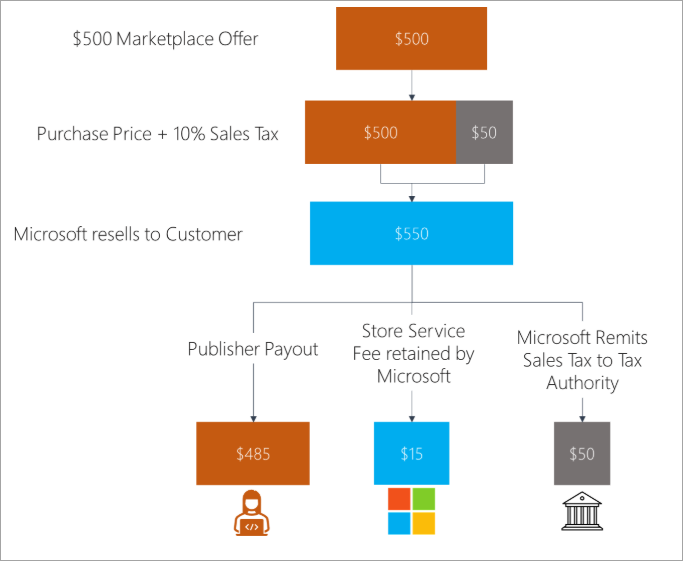

For more information, see the scenarios under Example 1, Microsoft-managed and Example 3, reseller.

In Publishers-managed countries, Microsoft deducts the Store Service Fee, any Store Service Fee Taxes, and any applicable withholding tax. The remaining payout amount is inclusive of any extra publisher tax responsibilities for which you're responsible.

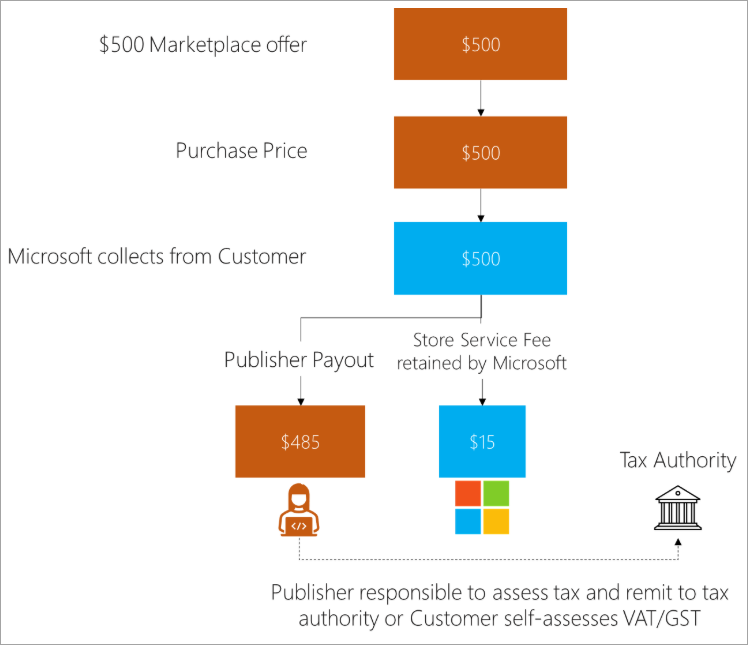

For more information, see Example 2.

You can visualize the withholding tax or other taxes deducted from the payout if it applies on the Earnings Report. For more information, see Marketplace earnings report.

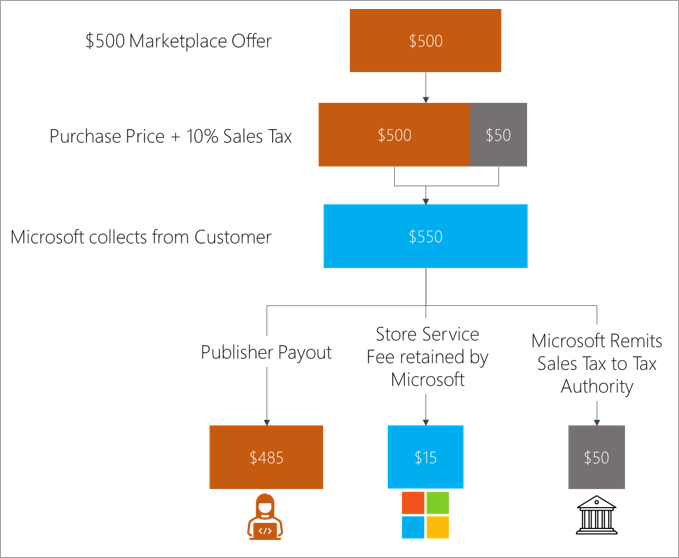

Example 1a: Microsoft-managed, US customer plus US publisher

This scenario shows the Microsoft-managed customer and publisher are in the United States.

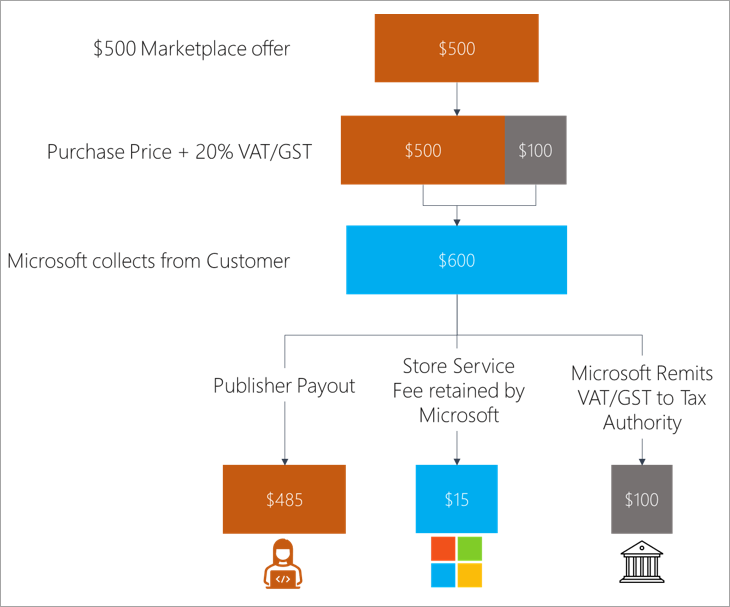

Example 1b: Customer in a country/region with a local entity plus zero WHT

This scenario shows the Microsoft-managed customer is in a country/region with a local Microsoft entity plus zero Withholding Tax (WHT) on publisher payout.

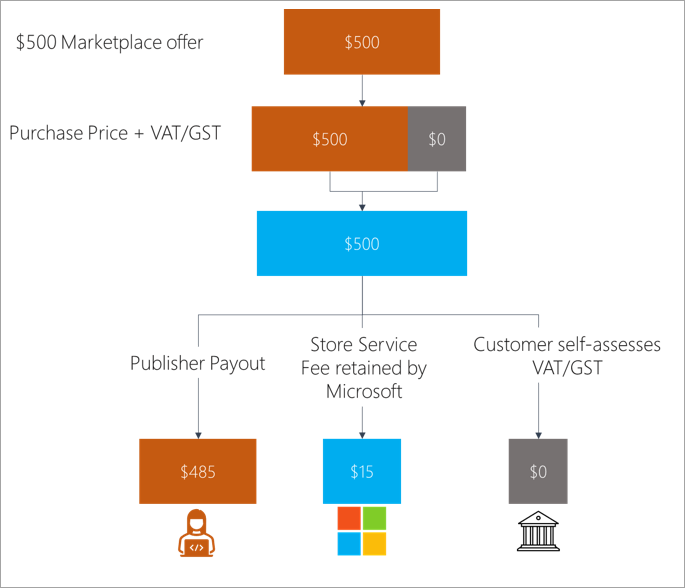

Example 1c: Business customer with a tax ID in a country/region with a remote Microsoft entity registered locally

This scenario shows the Microsoft-managed business customer with a tax ID in a country/region with a remote Microsoft entity that is registered locally plus zero WHT on the publisher payout.

Example 1d: Taxable customer in country/region with a remote Microsoft entity registered locally

This scenario shows a Microsoft-managed taxable customer in country/region with a remote Microsoft entity registered locally plus zero WHT on publisher payout.

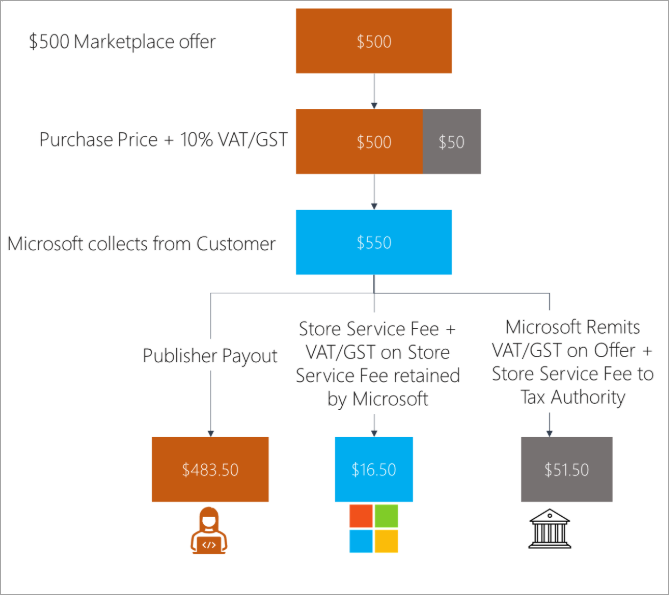

Example 1e: Customer in country/region with local Microsoft entity plus tax on Store Service Fee

This scenario shows a Microsoft-managed customer in a country/region with a local Microsoft entity plus tax on Store Service Fee and zero WHT on publisher payout.

Example 2: Publisher-managed customer in a publisher-managed country/region

This scenario shows a publisher-managed customer in a publisher-managed country/region.

Example 3: Microsoft reseller Brazil customer plus US publisher

This scenario shows a Microsoft reseller with a Brazil customer plus a US publisher and zero WHT on publisher payout.