Improve accuracy with general ledger account revaluation

Important

This content is archived and is not being updated. For the latest documentation, go to What's new or changed in Business Central. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically |  Mar 1, 2024

Mar 1, 2024 |

Apr 1, 2024

Apr 1, 2024 |

Business value

With a new setup on the G/L account card, you can now run G/L revaluations for accounts with transactions in foreign currencies. This enables you to generate a more accurate financial statement with little need to keep separate spreadsheets.

Feature details

If you use general ledger accounts to register balance sheet items that are denominated in foreign currencies, a revaluation of the balances is often required before you produce financial statements for your business.

Until now, most businesses have used either a bank account or a vendor account to register and track such assets and transactions. They’ve had to keep the bank or vendor account separate from others, and to make it work they’ve had to maintain an expanded setup for posting groups.

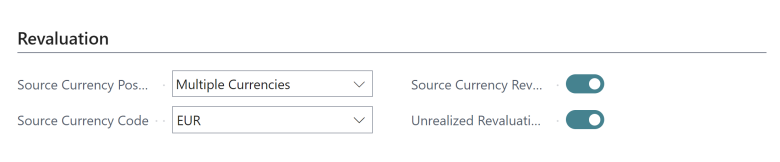

The G/L Revaluation feature simplifies revaluations. For a general ledger account, you can select to have it included in revaluations. You can also select if only specific currencies can be posted to the G/L account. This setup will be validated when you post to the account. For each account you can select to have revaluation adjustment entries posted as unrealized or realized gains/losses, which will depend on the type of assets you're keeping track of. Posting gains and losses during a currency exchange rate adjustment follows the normal posting routine. For example, it’s done as specified in the setup for each currency.

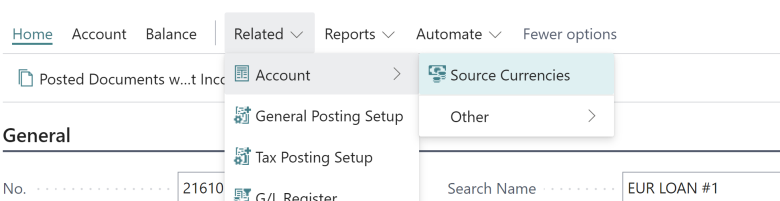

Each general ledger entry has the source currency code and the source currency amount as new fields, either for reference purposes only or for use in G/L account revaluations.

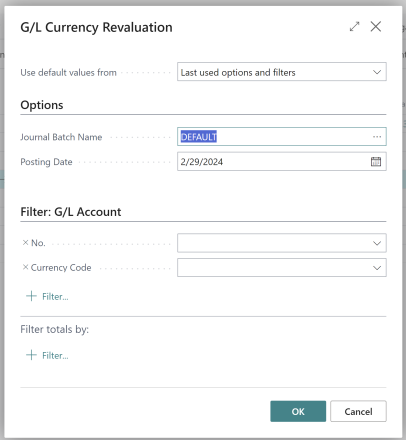

The G/L Currency Revaluation action starts a batch job for revaluations, and it's available on the Chart of Accounts page. The batch job creates adjustment entries in a journal you select, and when you post the entries you also adjust the local currency (LCY) balance on the G/L account. With G/L account revaluations, G/L account balances that always show in LCY are revalued so the balances in LCY reflect changes to the currencies in which entries were posted. This revaluation enables you to produce a more accurate financial statement with little effort.

If you're using an additional reporting currency (ACY), the G/L revaluation entries have an ACY amount. The amount only corresponds to the LCY amount on these entries, not the ACY balance on the G/L account. If you adjust the ACY rates after you post the adjustments, run the currency exchange rate adjustment one more time to adjust all G/L entries.

We separate the batch jobs because they're two different things, adjustments versus new entries.

Note

The G/L Revaluation feature might not meet all requirements for transaction and asset registrations that require revaluation. For example, for financial instruments, securities, leased assets, or if used for specific or large volumes of transactions or assets. We recommend that you discuss with your auditor whether you can use the feature.

Note

The new feature doesn’t provide the ability to apply or unapply entries. Adjustments are done on a balance per currency basis.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.